The home renovation tax credit (HRTC) is officially over – arguably a successful program put on by the government in an attempt to stimulate the economy. The sudden press coverage of it has reminded people that construction/renovation season is coming up, and there may very well still be rebates around.

And lucky enough for them, there are. The Retrofit Rebate Program is a joint program put on by the Government of Ontario and the Federal Government, each giving up to $5,000 for eligible renovations – for a total maximum of $10,000.

This program actually offers a much larger rebate than the Home Renovation Tax Credit – but is restrictive in what qualifies. The Retrofit Rebate Program is aimed specifically at increasing the energy efficiency of a home – and providing money back to home owners who do this. The money is in the form of a Government grant – not a tax credit, and is sent to you when you complete the program. The program consists of 3 basic steps – 1. Get an initial audit 2. Do the renovations and 3. Get the auditor back to verify the upgrades.

1. Initial Audit

The initial audit is a starting point or “baseline” for your house. The auditor takes note of your home’s current energy efficiency by taking pictures, taking notes of certain points (current insulation for example) and performing a blow-door test to determine air infiltration. This baseline will be used to determine what renovations you’re eligible for, and how large of a rebate you can receive from specific renovations. The cost of this is typically around $400, and roughly half is covered by the Government of Ontario. If you’re one of the people smart enough to be with RBC, they have a program that will pay for the rest of the initial audit. From the point of the audit – you have 18 months to complete your renovations and have the auditor back to perform the final assessment. If you don’t have him back within 18 months you get nothing back – and you can’t perform another audit to do more renovations at a later date.

You can get back up to $5,000 from the Government of Ontario and $5,000 from the Federal Government – for a total maximum of $10,000. How you get this money and how it is split between the two levels of Government is taken care of by your auditor.

![]()

2. Renovations

Your next step is select what renovations you want done. You want to focus your efforts on renovations that will provide the largest rebate, and make the biggest difference over the long run in reducing your heating and cooling bills. Of the renovations, the most common are arguably: Furnace replacement, Window replacement, Attic Insulation and Exterior Insulation.

A new, more reliable furnace is a popular option for those with models 15 years or older. A new furnace is not only more efficient and thus costs less to operate, but will give you a peace of mind that your furnace isn’t going to randomly break down, causing you to panic and overpay for a new one in a rush. $1,500 is a fairly substantial rebate when you consider that a new furnace will cost around $5,000, about a 30% rebate.

Window replacements is also fairly popular, but don’t provide very much in the way of a rebate. Anecdotally, I have been told it costs about $400 per window to replace, and you are eligible for $80 per window, about a 20% rebate.

Attic insulation is an odd one – most people I have encountered have had quotes for $500 to bring their attic up to the required R-50 – and the possible rebate for this one is $1,500 – a 300% rebate. I have heard (but don’t actually recommend this) of people removing attic insulation before the initial audit to bring it below an R-12 starting point, so that when they bring it up to R-50 they get the full rebate.

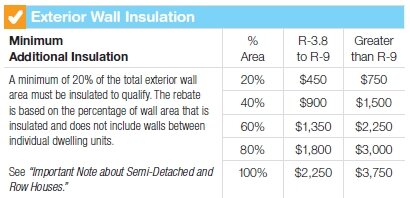

Finally – the most lucrative of all renovations is the exterior insulation rebate, under which of course – Exterior Insulation Finish Systems (EIFS / “synthetic stucco”) falls. The maximum possible rebate for adding R-9 insulation the exterior of your walls is $3,750 – which can be as much as 30% of the cost to renovate your home. The real opportunity in EIFS is what it provides on top of a large rebate – year round reduction in heating/cooling, and increased home value. Home owners have reported anywhere from 20%-40% reduction in heating and cooling bills from EIFS alone – potentially saving $1,000 per year (estimated average of $2,500 per year in heating+cooling costs). The average EIFS renovation would therefore pay itself off in 12-15 years, then put $1,000 per year back into your pocket – an 8% interest rate! When was the last time your bank offered you that?

EIFS has a secondary effect of greatly reducing air infiltration – possibly qualifying you for $480 for the “Air Sealing” rebate.

Finally, on top of over $4,000 in a rebates and $1,000 per year in reduced heating/cooling costs – EIFS increases your home valuation – reportedly in the range of 80%-120% of the cost of the renovation.

In conclusion – a typical EIFS retrofit may cost roughly $15,000. Of this $15,000, you can get back $4,000 in rebates, resulting in only $11,000 cost to you. At $1,000 per year in energy savings, it will pay for itself in 11 years – up to 13 years if you financed it. When it comes time to sell your home, you can expect to get an additional $15,000 because your home not only looks nicer, but has lower operating costs than others the ones buyers will be looking at. Until you do sell your home though, you can feel proud and fulfilled living in a beautiful home.

3. Post-Retrofit Audit

After completing all your renovations – and within the 18 month since the first audit – have your auditor back to review what you have done. Make sure to keep records of all payments made for the materials and to the installers, pictures sometimes help as well (such as taking a picture of 2.5″ insulation being installed, and the type of insulation, to prove it is R-9). Typical time for the auditor to complete his report, the Government to process it, and the cheque to be mailed is 8-12 weeks.

Don’t wait any longer – you know deep down that you want a gorgeous looking home, the excitement of renovating and improving your home, and that it makes logical sense. Book your home energy audit and request an estimate to have your home retrofitted with EIFS.

Update: September 08, 2010

I was under the original impression that the program ended March 31st 2010 – however, from the look on the website it looks like it was just the Federal government portion that was not renewed. It seems as though you can still get half the grant – $1,875 for insulation – from the Government of Ontario.

1 Comment